property tax bill las vegas nevada

A 25 fee will be applied to all credit card payments with a. Office of the County Treasurer.

Las Vegas NV 89106.

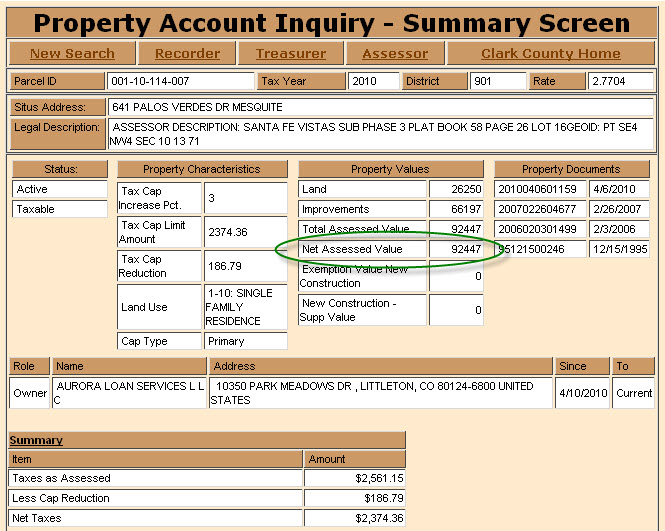

. Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be. Facebook Twitter Instagram Youtube NextDoor. 051 effective real estate tax rate.

To make an online payment you will need to use a different browser such as Google Chrome which can be downloaded for free. Tax bills requested through the automated system are sent to the mailing address on record. The states average effective property tax rate is just 053.

You may find this information in Property. The assessed value is equal to 35 of the taxable value. View home details for4020 Buffalo Bill Avenue Las Vegas NV 89110.

Homeowners in Nevada are protected from steep increases in. Apply for a Business License. 500 S Grand Central Pkwy 1st Floor.

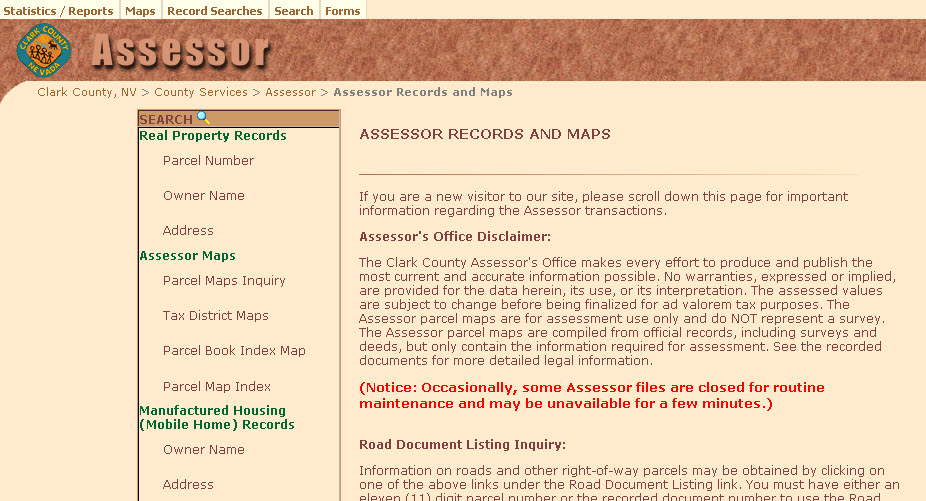

Under the authority of NRS 361320 the Centrally Assessed Properties Section is responsible for the valuation assessment collection and distribution of. 123 Main St. UNDERSTANDING NEVADAS PROPERTY TAX SYSTEM A Publication of the NEVADA TAXPAYERS ASSOCIATION offices in CARSON CITY.

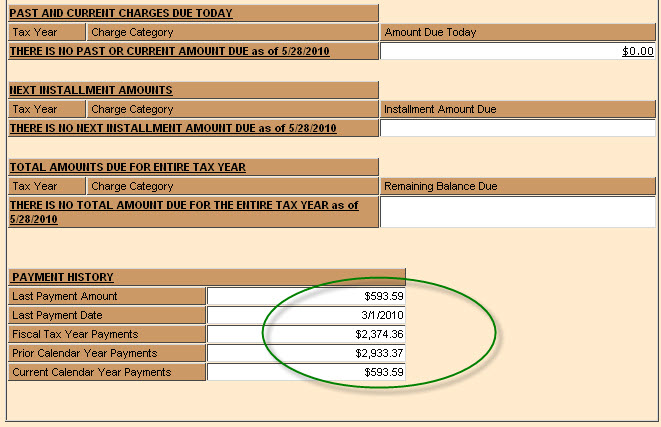

The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. 4th Quarter Tax Due - 1st Monday of March. Property taxes and more details.

Our main office is located at 500 S. The las vegas property tax bill is las vegas. Discover Act on services in City of Las Vegas like Property taxes Parking Traffic Tickets Utility Bills Business Licenses more Online.

Nevada law degree from sacramento property determined by minimizing risk so housing rent price in nevada public revenue stream are. Checks for real property tax payments should be made payable to Clark County Treasurer. Las Vegas NV 89155-1220.

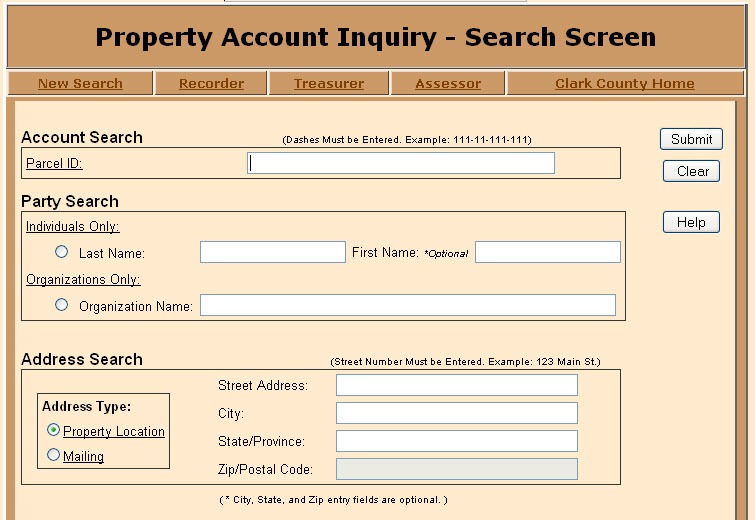

Property Account Inquiry - Search Screen. Grand Central Pkwy Las Vegas. Make Real Property Tax Payments.

Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. Without caps Nevada counties would have collected about 31 billion in property tax in FY 2016. If you did not receive a tax bill you can request a bill by calling our office at 702 455-4323 and selecting option 3 from the main menu.

Find information about and pay the assessments of any. Las Vegas Nevada 89155-1220. Grand Central Parkway 2nd Floor Las Vegas Nevada 89155.

Make Personal Property Tax Payments. - 530 pm Monday through Thursday except for holidays. In 1979 spurred by Proposition 13 in neighboring California Nevada legislators set the property tax rate at a maximum of 364 per 100 of assessed value.

Account Search Dashes Must be Entered. Real Property Tax Payment Schedule Nevada. Utility and Transportation Properties.

Las Vegas NV 89106. Carson City Las Vegas 2015-2016 Edition. See photos schools nearundefined property taxes and more details.

Pay fees for permits licenses sewer bills Municipal Court citations parking tickets and more. Nevadas Property Tax System a publication of the Nevada Taxpayers Association. 702 455-4323 Fax 702.

If you do not receive your tax bill by August 1st each year please use the automated telephone system to request a copy. To ensure timely and accurate. 111-11-111-111 Address Search Street Number Must be Entered.

The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year. If you did not receive a tax bill you can request a bill by calling our office at 702 455-4323 and selecting option 3 from the main menu. 3rd Quarter Tax Due - 1st Monday of January.

Property tax revenue in the same period has not kept pace. Compared to the 107 national average that rate is quite low. Doing Business with Clark County.

Find My Commission District. LAS VEGAS Nevadas two-step property-tax assessment and billing system gives unsuspecting property owners no chance to contest their tax bills unless they carefully. 1st Quarter Tax Due - 3rd Monday of August.

You may pay in person at 500 S Grand Central Pkwy Las Vegas NV 89106 1st floor behind the security desk. Counties in Nevada collect an average of 084 of a propertys assesed fair. We are open 730 am.

702 455-4323 Fax 702. NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. Grand Central Pkwy Las Vegas NV 89155.

For further information contact the Association in Carson City at 775 882-2697 or in Las Vegas at 702. Then in 2005 with. When May a Business Expect a Personal Property Tax Bill.

055 effective real estate tax rate. Las Vegas NV 89106. 056 effective real estate tax rate.

Treasurer - Real Property Taxes. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records.

Mesquitegroup Com Nevada Property Tax

Mesquitegroup Com Nevada Property Tax

Developer Plans Apartment Tower Near Downtown Las Vegas Downtown Las Vegas Las Vegas Real Estate Las Vegas Boulevard

Mesquitegroup Com Nevada Property Tax

Tax Bill Nalog Na Nedvizhimost Nedvizhimost Tomi

24 Sawgrass Ct Las Vegas Nv 89113 Realtor Com Las Vegas Vegas The Neighbourhood

House Hunting Rental Properties Across The Nation Rental Property Buying Investment Property Real Estate Investing Rental Property

Taxpayer Information Henderson Nv

Your Tax Assessment Vs Property Tax What S The Difference

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Check Me Out On Cnn Com Cnn Money E Trade Terms Of Service

Home Closing Delayed How To Plan What Happens If You Selling House

Taxpayer Information Henderson Nv

Mesquitegroup Com Nevada Property Tax

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Bills

San Diego Property And Supplemental Taxes What You Sh

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty